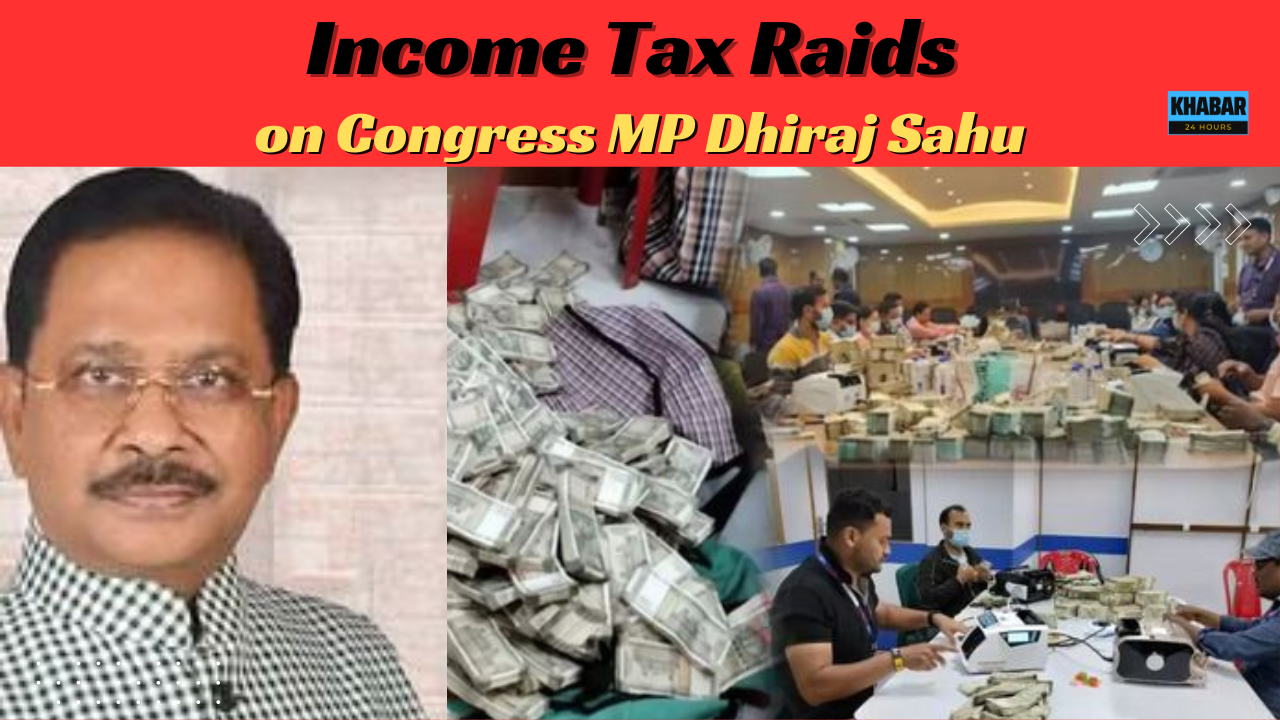

Introduction: In a significant turn of events, Income Tax authorities recently conducted raids on the premises of Congress Member of Parliament, Dhiraj Sahu. The operation, which has concluded, has brought to light an astounding sum of Rs 340 crore. This development has sent shockwaves through the political landscape, raising questions about financial transparency and accountability.

The Raid and its Scope: The Income Tax department initiated the raid on Dhiraj Sahu’s properties, encompassing various locations associated with the Congress MP. The operation aimed at uncovering any potential discrepancies or undisclosed assets that might be in violation of tax regulations.

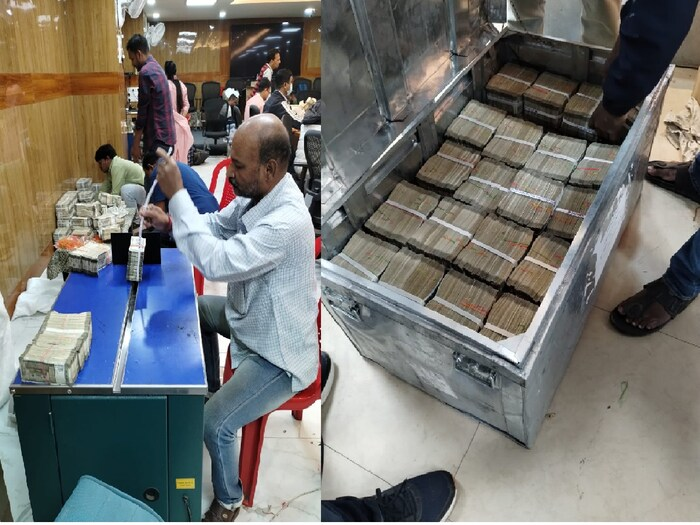

Counting Concludes: As the exhaustive counting process reached its conclusion, the total amount unearthed stands at a staggering Rs 340 crore. This includes both liquid assets and investments in diverse sectors. The revelation has not only triggered a political uproar but has also fueled public concern regarding the financial dealings of elected representatives.

Allegations and Response: While no official statement has been released by Dhiraj Sahu in response to the raids, political opponents and critics have been quick to raise questions. Allegations of financial impropriety and potential tax evasion are likely to be central to any subsequent investigation.

Political Ramifications: The timing of these revelations adds another layer of complexity, considering the ongoing political climate. The opposition is expected to leverage this incident to question the integrity of the ruling party and demand a thorough investigation into the finances of its members.

Public Reaction: The disclosure of such a substantial amount has naturally triggered public outrage and demands for greater transparency in the financial dealings of elected officials. Social media platforms are abuzz with discussions and debates, reflecting the public’s growing concern about the nexus between politics and financial irregularities.

Legal Implications: The Income Tax raid on Dhiraj Sahu brings forth potential legal implications. If any evidence of tax evasion or financial misconduct is found, it could result in legal proceedings against the Congress MP. The legal process will be closely watched as it unfolds, given its potential impact on political dynamics.

Conclusion: The Income Tax raids on Congress MP Dhiraj Sahu and the subsequent revelation of Rs 340 crore have added a new dimension to the ongoing discourse on political transparency. As investigations proceed, the fallout from this incident will likely shape public opinion and contribute to the evolving narrative surrounding the intersection of politics and finance in the country.